Very little research has been done in devising the tools to attract deposits. KUALA LUMPUR March 10 Islamic finance is set for a turnaround post Covid-19 spurred by several factors including digitalisation said an industry expert.

Pdf Unfairness In Islamic Finance Contracts The Malaysian Case

Malaysia issues RM3 billion US68127 million Malaysian Islamic Treasury Bill.

. Malaysia is the third-largest market for global Islamic finance products and the worlds largest issuer of Islamic bonds also known as Sukuk. These awards continue to be an apt representation of the current Islamic financial market landscape. 1- Introduction It is a matter of great satisfaction that the Islamic banking and finance sector is presently growing at a very fast pace in Muslims countries but still there are a lot of challenges ahead to get a fully.

October 30 2015 1900 pm 08. With these features of the Islamic banks the following issues arise. Shariah Issues in Islamic Finance 10 f Syed Salman 1300218 32 Bai Al-Dayn 3211 1st Issue.

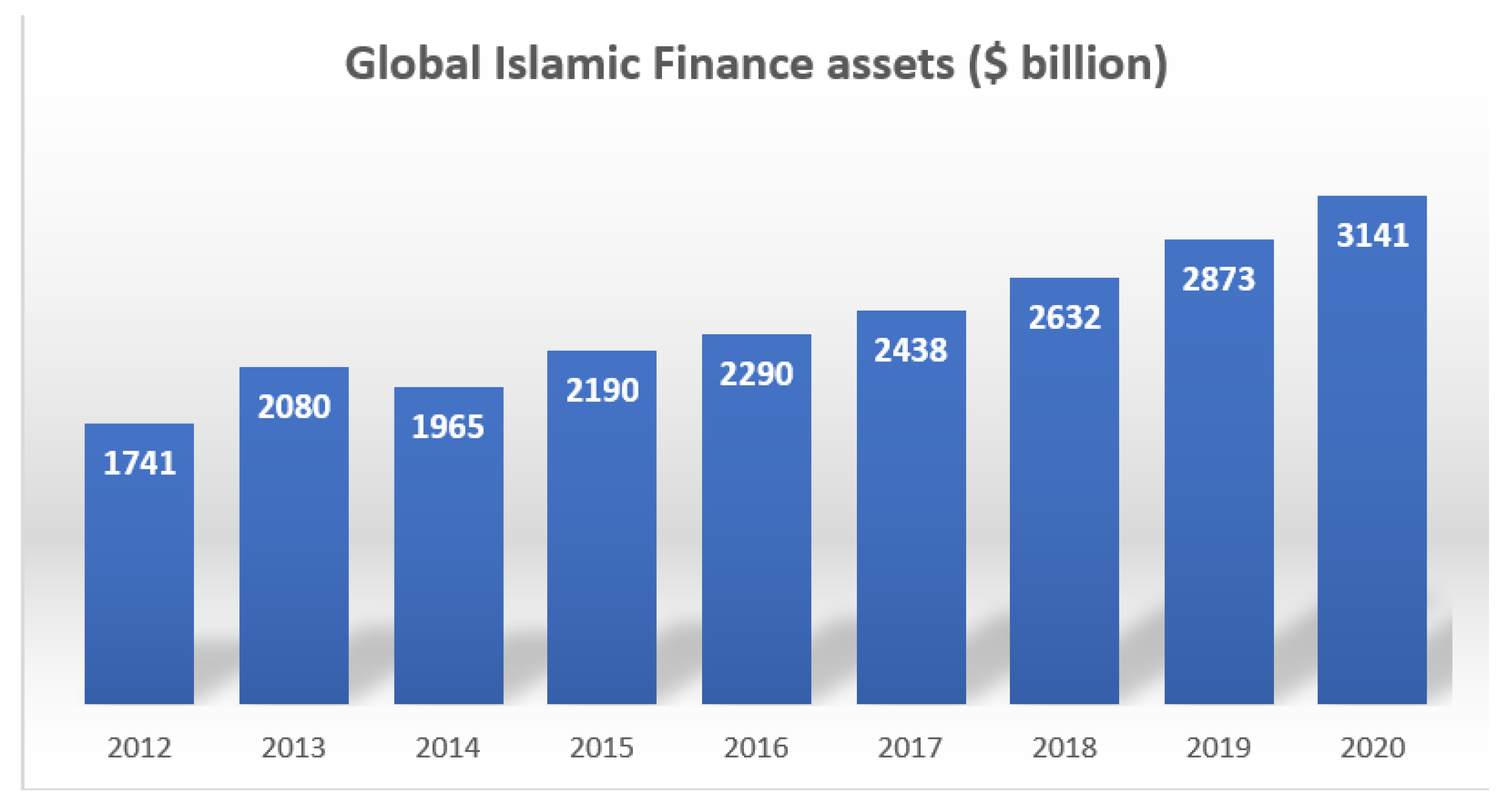

The Islamic banking and financial services industry showed a rapid growth during the last 10 years having accomplished a milestone reaching a value of more than 2 trillion by 2015. Islamic financial institutions are lagging far behind the level necessary to enable them to thrive and compete effectively in a freely competitive global environment. A comprehensive market infrastructure and a robust and progressive regulatory framework are already in place.

Realising the need to explore new opportunities to bring Islamic finance to the next level Malaysia has recently introduced value-based intermediation VBI principles. Fitch Ratings-Singapore-28 February 2021. 35 with Islamic financing contributing nearly all of the banking sectors growth in.

It is my pleasure to be here today at this conference organised by ASLI to speak on the current issues and developments in Islamic banking and finance. Under its Capital Market Masterplan 2 the countrys Shariah-compliant financial sector is expected to sustain double-digit growth to reach almost RM3trn 961bn in 2020. Financial services particularly banking are by nature long-haul business.

Based on the same ranking system Malaysia took the lead in other Islamic finance sectors such as financing real estate and financial technology or fintech. There are more than 15 billion Muslims all over the world and it is estimated that right around one of every four individuals on the planet rehearses Islam. It focuses specifically on Islamic banking and Islamic capital market research.

According to RAM Ratings Malaysia was the top sukuk issuer with US139 bil ringgit equivalent or 351 of the US395 bil ringgit equivalent sukuk issued. Malaysias rank was similar in the takaful sector for that year but with Saudi Arabia as the leader followed by Iran. The data in the Economic Outlook 2021 report published by the Finance Ministry MoF shows that the Islamic banking industry in Malaysia has expanded with.

The Islamic finance industry in Malaysia is characterised by having comprehensive market components ranging from Islamic banking takaful Islamic money market and Islamic capital market. ZAKI not his real name is a former civil servant who was declared bankrupt by the civil courts when he did not repay. IFN Weekly Market Round-up.

Malaysias Islamic banking sector continued to expand amid economic challenges from the coronavirus pandemic says Fitch Ratings. 4th 10th June 2022. In Malaysian Capital Markets The securities commission has referred this as.

The Islamic banks so far have undertaken extensive research in devising non-usurious procedures to utilize their funds. The shariah debate on Islamic financing. This article first appeared in The Edge Malaysia Weekly on October 12 - 18 2015.

Qatar First Bank to commence rights issue from the 15th to the 28th June 2022. Islamic banks at least in Saudi Arabia and Egypt have departed from using profit-loss-sharing techniques as a core principle of Islamic banking according to a 2006 dissertation by Suliman Hamdan AlbalawiMalaysia has also seen a decline. One study of which modes of Islamic finance were used most frequently found PLS financing in leading Islamic banks had declined from.

Tools to Attract Depositors. Islamic Financial Industry Accounting Issues Accounting Reporting Standards New Scheme of Study. The Islamic banking industry in Malaysia is paving the way for a new phase of development.

April 2022 1 March 2022 1 February 2022 2 October 2021 1 August. Trading of Debt Bai Al-Dayn is a combination of Bai Sale and Dayn which is referred to as Debt. The Edge Financial Daily.

Sultan Zainal Abidin University Terengganu Malaysia yusuffyjauniszaedumy. This book provides a timely examination of the issues confronting this US300US500 billion market growing at 1520 per annum with reviews of the different financial markets be they capital Sukuk retail or wealth management. Bai Al-Dayn is also referred as Bai Al-Kali Bil-Kali or Bai Al-Dayn Bil-Dayn.

Wahed Invest announces footballer Paul Pogba as brand ambassador. The share of Islamic financing in the banking system reached 37 by end-2020 end-2019. The Islamic financial system in Malaysia has evolved as a viable and competitive component of the overall financial system complementing the conventional financial system as a driver of economic.

It is pertinent to mention that myriad Islamic fintech. - A A. Sunway Treasury Sukuk prints Islamic commercial paper worth RM50 million US1135 million MALAYSIA.

Which is why there is a need for Islamic financial institutions to be adequately capitalized. Wednesday 10 Mar 2021 604 PM MYT. This introductory article of the special issue Islamic Banking and Finance II highlights various studies on fast-growing Islamic finance industry.

It further includes reviews from the various jurisdictions including Malaysia the front-runner Singapore. Islamic Corporation for the Development of the Private Sector ICD chief executive officer Ayman Sejiny said the pandemic has accelerated the. Current issues in Islamic banking and finance in order to improve the system and remove all.

Johor Corporation places three Murabahah- and Wakalah-based Sukuk papers.

Islamic Finance Gears Up Finance Development December 2005

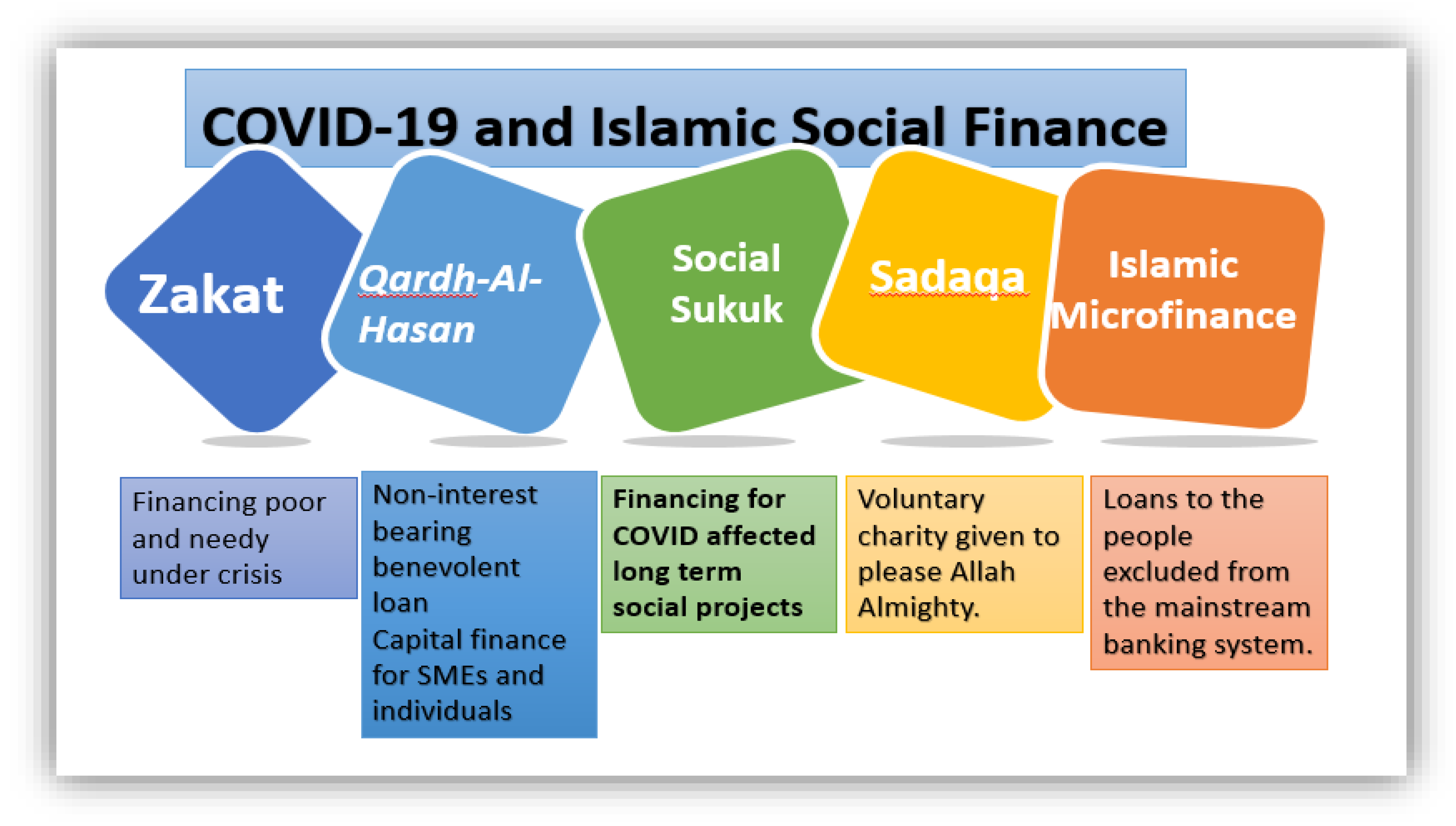

Joitmc Free Full Text Exploring The Role Of Islamic Fintech In Combating The Aftershocks Of Covid 19 The Open Social Innovation Of The Islamic Financial System Html

Jrfm Free Full Text Developments In Risk Management In Islamic Finance A Review Html

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

Fintech Digital Currency And The Future Of Islamic Finance Springerlink

Islamic Banking Services In Malaysia With Its Concept Of Shariah Download Table

Pdf Emerging Issues In Islamic Banking Finance Challenges And Solutions

Pdf The Global Perspective Of Islamic Finance And The Potential For China To Tap Into The Islamic Finance Market

Pdf Islamic Finance Operational Transaction Framework A New Insight Of Islamic Finance Implementation In Malaysia And Japan

Basic Rules Of Islamic Finance C Download Scientific Diagram

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

Joitmc Free Full Text Exploring The Role Of Islamic Fintech In Combating The Aftershocks Of Covid 19 The Open Social Innovation Of The Islamic Financial System Html

Islamic Banking In Malaysia Cases And Commentaries Clj

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia